Whether from broken pipes, leaky water heaters, or natural disasters, house floods are (unfortunately) all too common.

In fact, the average flood damage claim runs to about $52,000, according to the Federal Emergency Management Agency (FEMA). Even flooding caused by non-natural disasters is expensive.

For homeowners who experience a flooded house due to plumbing or appliance failure, the average cost of water damage ranges from $3,000 to $17,000!

Just one inch of water in your home causes damage that costs about $27,000 to fix. Some damage may be covered by flood insurance, but most standard homeowners insurance alone doesn’t usually cover flood damage.

No matter how careful you are, house floods happen — and the cleanup and repairs that follow aren’t cheap or easy. Here’s what you need to know about how to deal with a flooded house… and how to get your life back to normal.

How Do House Floods Happen?

Imagine going away for a weekend (or even just a few hours) and coming home to find your house flooded. Perhaps the water heater finally gave out, pouring hundreds of gallons of water onto your floor and baseboards.

Maybe a pipe in the ceiling sprung a leak, soaking through the drywall, hardwood floors, carpets, and your furniture. Or the sewer pipes backed up, creating a horrible mess to clean up and leaving your home barely habitable along the way.

But house floods from natural disasters can be much more serious.

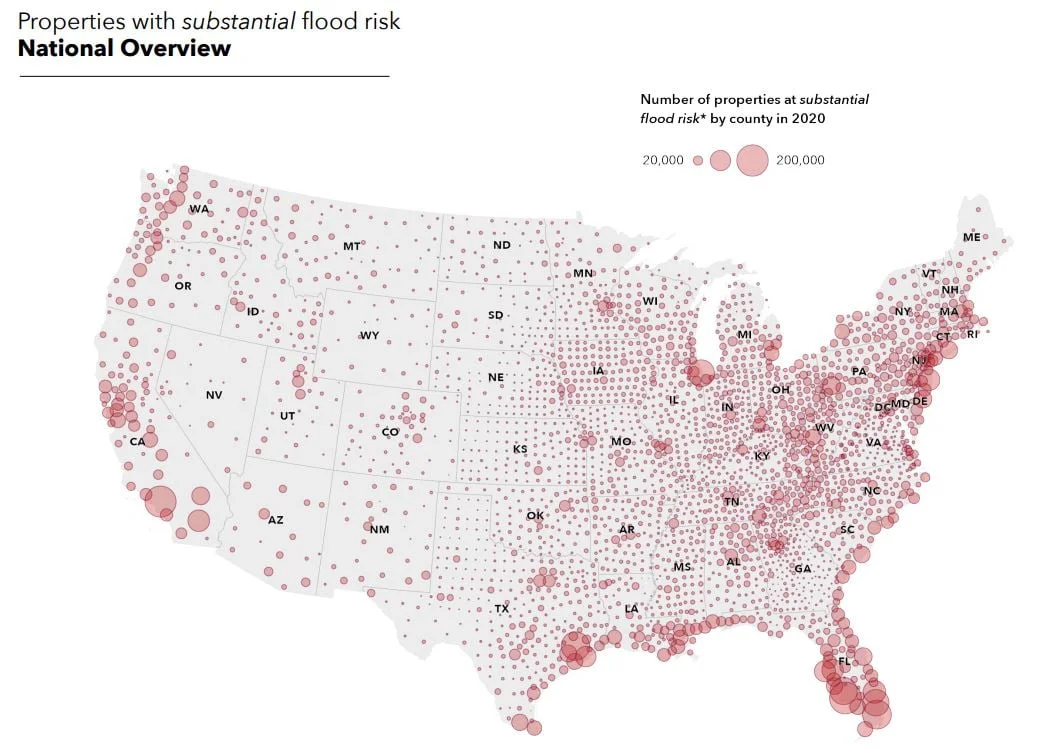

According to FEMA, 99 percent of counties across the U.S. were impacted by at least one flooding event between 2013 and 2019. Even if you don’t live in a flood-prone area, heavy rains and monsoons can wreak havoc on your home.

Water damage can weaken a home’s structural integrity, impact electrical systems, damage your plumbing, ruin appliances, and destroy your furniture and personal belongings.

All types of flooding cost time and money and can make your home difficult to sell later on.

Avoiding House Floods

Taking steps to avoid flood damage now save you heartache and spare your wallet later. The Insurance Institute for Business and Home Safety recommends taking the following actions to protect your home, belongings, and family from house flooding:

- Research flood zones. Is your home located in a high-risk area? FEMA offers an interactive flood zone map, so take a minute and enter your address. Your local government offices may have more helpful information about flood risk in your area. Just keep in mind that floods can take place anywhere, even in areas with minimal risk.

- Determine your Base Flood Elevation. If your home’s lowest floor is below the base flood elevation (BFE) for your property, there’s a higher risk of flood damage. Elevating your home to at least three feet above BFE will reduce some risk.

- Move electrical components. Ensure that sockets, switches, and other electrical components are at least 12 inches above BFE. This reduces the risk of both damage from floods and fires from short circuits. You may need to hire an electrician to make these changes in your home.

- Elevate HVAC equipment. Similarly, raise your HVAC equipment well above BFE. For example, you may want to place an A/C unit on the roof. You could also construct a flood-proof wall around HVAC units to keep them dry.

- Slope land away. Ensure the land around your home is sloping in the right direction. Slopes should direct water away from the home.

- Secure the sewage line. Hire a plumber to install a sewer backflow valve. An interior or exterior valve can prevent waste from coming up through the drains and into your home.

- Protect your drinking water. Hire a contractor to inspect your well and suggest ways to protect it from groundwater contamination in the case of a flood.

- Keep valuables safe. If you’re storing any valuables in a basement or crawlspace, move them out and up to higher ground.

- Install water leak alarms. Leak alarms and auto shut-off systems can help prevent damage from leaks. Even a simple alarm like this can save you thousands in the event of a water leak.

What Kind of Damage Does a House Flood Cause?

While, of course, each situation is different, water damage from flooding is often extremely serious. Common issues may include:

- Foundation damage leading to broken slabs, cracked walls, ruptured pipes, and sagging roof

- Drywall softens, crumbles and molds

- Wet insulation must be removed and replaced

- Structural sheathing swells and loses integrity

- Electrical system problems

- Insulated appliances, such as ovens and refrigerators, absorb water and are usually ruined

- Upholstered furniture and items made from particleboard absorb contaminants and should be discarded

- Flooring: carpet and laminate must be replaced, hardwood and tile may be salvageable

What to do During a House Flood

If a flood is on the way (or underway), think safety first. Start by turning off the electricity; flip off the main breaker, even if there’s a power outage. Electricity and water aren’t a good mix.

If the flood isn’t an act of nature (i.e. a burst pipe) cut it off at the source. It may be easiest to simply turn off your home’s main water valve, in case you can’t determine the source of the flooding right away.

It is always a good idea to know where your main water shutoff valve is and have all the necessary tools nearby to turn it off within a minute should disaster strike.

Next, gather in a dry, safe spot outside the home and make sure everyone — kids, family members, pets — are safe. If the flood is a natural disaster, find a secure shelter, and monitor the news to remain informed.

What to do Directly After Your House Floods

When it’s safe to go back in, suit up in protective gear like rubber boots and gloves. There may be contaminants in the water. Watch out for gas lines or live electrical wires.

Next, grab a camera. Before you even think about cleaning up, document the damage. If you have insurance, your insurer will want a photographic and video record of everything that was damaged.

Keep careful records of everything, from insurance claims to invoices for repair costs. You may even want to cut out bits of carpet, flooring, walls, or upholstery to have a record of the damage.

Now comes the “fun” part: Removing the water. Once you’ve gotten the go-ahead from your insurer, the hard work begins. Water removal is a difficult process, so prepare for the long haul.

You may want to purchase a sump pump and a wet vac, which typically run from $150 to $500.

One caveat: If you’re pumping out a heavily flooded area, such as a basement, do it in stages of about one-third of the water per day, according to the Philadelphia Inquirer.

Pressure from the water may cause structural shifts, and removing all the water quickly can lead to wall collapse.

If you’re using buckets to remove water, take it easy and slow. Water is surprisingly heavy, so it’s easy to injure yourself by carrying too much or lifting incorrectly.

Along with the water damage itself, mold is a major problem. Not only is it unsightly, toxic, or “black” mold can also cause health issues and make it hard to sell your home later.

Open doors and windows to increase circulation. This helps reduce mold and mildew.

If you have a dehumidifier, turn it on. This appliance is helpful when drying out enclosed spaces, such as closets, basements, or crawl spaces.

Throw out any unsealed or exposed food, as it may be contaminated. You may also need to discard carpet, padding, window coverings, and upholstered furniture. Keep swatches to show your insurance company.

Now it’s time to sanitize. Scrub down walls, floors, tiles, hard surfaces, and appliances that have come in contact with the water. Use a non-ammonia detergent, then disinfect with a solution that contains bleach.

What Options Do I Have After a Flooded House?

Your post-flood options depend largely on the amount of damage your home has sustained. If you’ve experienced a small flood and the damage is minor, you may be able to simply mop up the standing water.

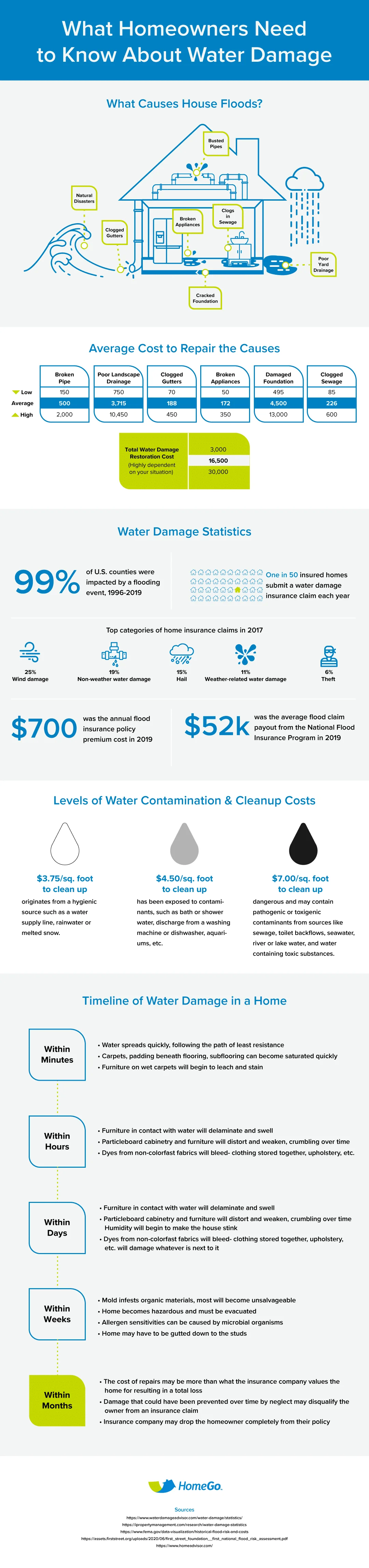

Your situation will be highly dependent on the amount of time the water has been collecting and causing damage. Here is an estimated timeline of events:

- Within minutes

- Water spreads quickly, following the path of least resistance

- Carpets, padding beneath flooring, subflooring can become saturated quickly

- Furniture on wet carpets will begin to leach and stain

- Within Hours:

- Furniture in contact with water will delaminate and swell

- Particleboard cabinetry and furniture will distort and weaken, crumbling over time

- Dyes from non-colorfast fabrics will bleed- clothing stored together, upholstery, etc.

- Within 24 Hours:

- Furniture in contact with water will delaminate and swell

- Particleboard cabinetry and furniture will distort and weaken, crumbling over time

- Humidity will begin to make the house stink

- Dyes from non-colorfast fabrics will bleed- clothing stored together, upholstery, etc. will damage whatever is next to it

- Within Days:

- Fungi and mold becomes visible, musty odors present

- Wood may severely warp and cup, making most wooden floors unsalvageable

- Painted walls will blister, wallpaper will begin to peel away

- Structural wood within home, such as framing, may begin to swell and split

- Within Weeks:

- Mold infests organic materials, most will become unsalvageable

- Home becomes hazardous and must be evacuated

- Allergen sensitivities can be caused by microbial organisms

- Home may have to be gutted down to the studs

- Within Months:

- The cost of repairs may be more than what the insurance company values the home for resulting in a total loss

- Damage that could have been prevented over time by neglect may disqualify the owner from an insurance claim

- Insurance company may drop the homeowner completely from their policy

In addition to the amount of time the water has been damaging your home, you will need to consider the type of water that has flooded your home.

There are three categories:

- White Water

- $3.75 per sq. foot to clean up

- Originates from a hygienic source such as a water supply line, rainwater or melted snow.

- Gray Water

- $4.50 per sq. foot to clean up

- Has been exposed to contaminants, such as bath or shower water, discharge from a washing machine or dishwasher, aquariums, etc.

- Black Water

- $7.00 per sq. foot to clean up

- Dangerous and may contain pathogenic or toxigenic contaminants from sources like sewage, toilet backflows, seawater, river or lake water, and water containing toxic substances.

After a thorough cleaning and a drying out period, you may be able to get back to some semblance of “normal.”

Just be aware that there may be “hidden” damage in corners of your home, so be sure to check for mold and other problems. Minor flood damage, if properly cleaned up, is less to affect the sale of your home if you nip problems in the bud.

If you experience moderate damage, you’ve got some work ahead. You may need to remove and replace baseboards, insulation, drywall, and wall tiles to at least four feet above the flood line.

You may try to salvage carpet with shampoo and drying, but it’s often not a possibility. If you can’t clean and dry carpets completely, they likely need to go. Unfortunately, you’re likely to lose upholstered furniture, as well.

When selling a home that’s experienced moderate flooding, you may face issues. Structural damage may be present, but not immediately visible… so a home inspection before the sale can uncover issues that make your home hard to sell.

What about severe damage after a house flood? Unfortunately, this scenario can really throw a wrench into your plans to sell.

Severe structural damage is common after a serious flooding event, and can often be a deal-breaker when selling a home. In fact, structural damage is among the top factors that result in a low home appraisal, which itself is a top cause of home sales falling through.

In most cases, an extensive remodel and mold treatment is the only solution. This can take weeks or months, and it’s not cheap.

On top of construction costs, you’re also stuck with replacing the furniture, appliances, window treatments, and all of the items that were ruined or lost in the flood.

You may also have to deal with being displaced for months, adding yet another layer of cost, frustration and complexity to an already complicated and difficult situation.

No matter what level of damage, you can take steps during the recovery process to prevent or minimize future flooded house damage. These include:

- Rebuilding at least two feet higher than required by your local zoning code

- Adding flood openings to basements, crawl spaces, or garages that lie below the first floor

- Replacing insulation with closed-cell insulation and water-resistant wallboard and sheathing

- Elevating your appliances above the BFE

- Installing non-absorbent flooring and using water-resistant sealant/mortar

- Elevating your existing home to a higher level or relocating it to a higher point on your property (both very expensive options)

If Your House Flooded, How Do You Get Things Back to Normal?

If you’re dealing with a flooded house, you probably just want your life to go back to how it was before. But given that average costs to repair a flooded house run into the tens of thousands, many homeowners struggle with the decision whether to pay out of pocket for repairs or use their insurance.

And what about homeowners that don’t have flood insurance, or whose insurer refuses to pay? It’s a common problem, but one that leaves you high and dry.

The good news: In situations like these, you still have options. When your home has suffered flood damage, you can get your life back to normal and move on by selling to HomeGo. HomeGo purchases homes in as-is condition, even those that have experienced severe flood damage.

You don’t have to spend time and money fixing the home before you sell. You don’t have to worry about the inspection and the appraisal. You don’t even have to clean up for showings. HomeGo makes a firm cash offer on the spot, and sales often close within 7 days.