As any homeowner who experienced an “underwater” mortgage during the Great Recession will tell you, the last thing anyone wants is a repeat of the 2008-2009 housing market.

But thanks to the current economic state of affairs, many housing experts are warning homeowners to prepare for the return of a particularly nasty phenomenon: the zombie foreclosure. It’s a scary term for a house that’s been sitting empty for a long time as it awaits foreclosure.

Are foreclosures increasing? Though it’s a bit too early to predict COVID-19’s full effect on the housing market, many realtors are seeing zombie foreclosures on the rise.

Read on to learn what you need to know how to avoid a zombie foreclosure during a pandemic.

Return of the Zombie Foreclosure

While we’re not reaching 2008-2009 levels yet, realtors in various areas of the country are seeing an increase in zombie foreclosure rates.

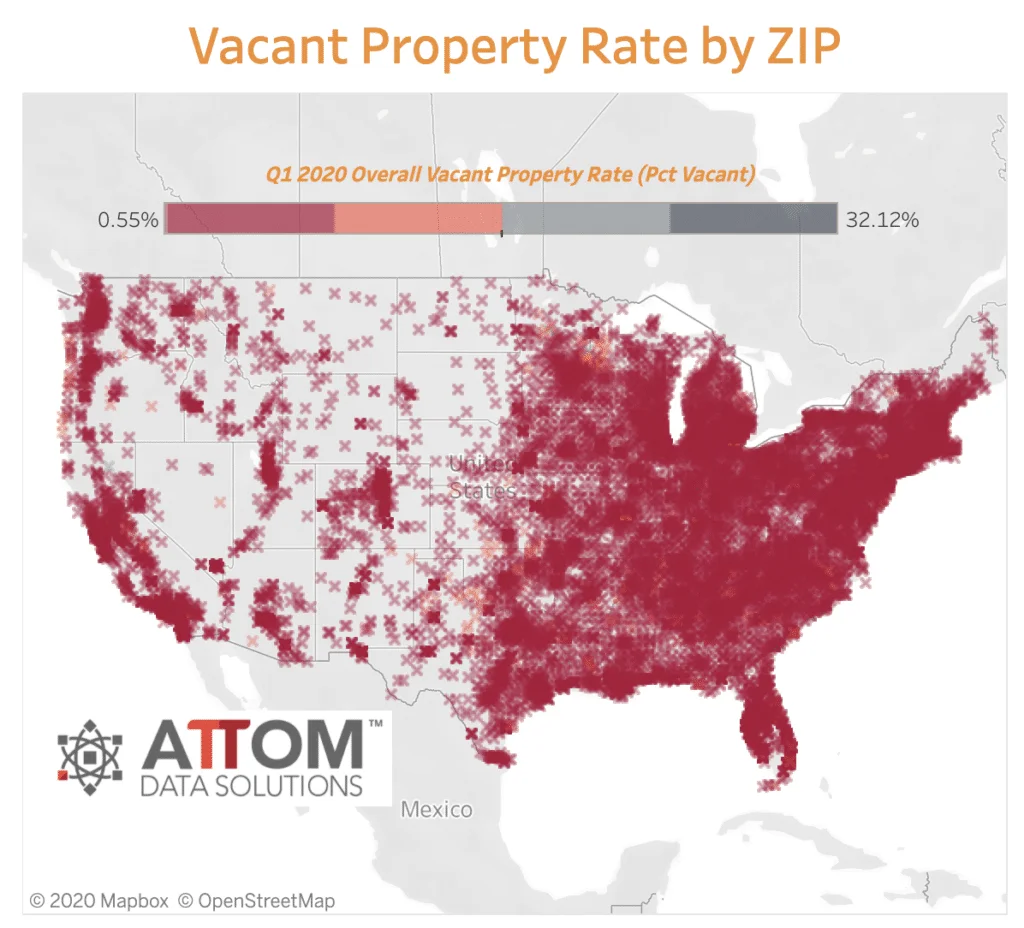

A recent report from ATTOM Data shows that in the first quarter of 2020, the number of zombie foreclosures across the U.S. increased by more than 3 percent.

That’s up to 8,700 homes sitting empty across the nation, waiting to foreclose. Unfortunately, these zombie properties aren’t just bad for the owners who default on payments.

Unoccupied, unmaintained properties are also bad for neighbors in the community, who may see their own property values decrease.

Foreclosed properties are often in poor condition, and once a home goes into foreclosure, it becomes much harder to sell.

For homeowners who worry they may face foreclosure, selling now — before circumstances worsen — simply makes sense.

Why are Foreclosures Increasing?

Foreclosure rates are on the rise, as well. At the end of March 2020, there were more than 282,000 homes in foreclosure, as reported by the Washington Post.

For those who live in neighborhoods with zombie or regular foreclosures, the trend is especially worrisome. While some foreclosures are handled quickly and quietly and look just like a normal sale to outsiders, others aren’t quite as “invisible.”

In the case of a zombie foreclosure, the lawn may become overgrown. The paint may begin to peel. Windows may be broken or boarded up. When a home becomes an eyesore, home values in that neighborhood may decrease.

Why? Because, as explained by the Balance, home appraisals depend, in part, on sales comps. When a foreclosed property, zombie foreclosure, or otherwise distressed home sale is used as a sale comp, it can drive down the value of the home being appraised.

Foreclosures in the Great Recession

Looking back to the Great Recession, how did high rates of foreclosed and abandoned homes affect the housing market? In 2008, foreclosures spiked by 81 percent.

More than 3 million homeowners experienced foreclosure, a staggering number that boils down to one of every 54 households.

During the same year, home values dropped by more than eight percent. Overall, CNN reports that homeowners lost a collective $2 trillion in home value, leaving almost 12 million Americans “underwater” on their mortgages.

No one is suggesting that the pandemic will lead to catastrophic market conditions. But with zombie foreclosures on the rise, homeowners need to be aware of all their options.

Selling your home before it reaches zombie foreclosure — or full foreclosure — status simply makes sense. If you live in a neighborhood with zombie foreclosure warning signs, you should also consider your options.

Your neighbors’ homes falling prey to zombie foreclosure can really lower the value of your own home, so in many cases, it makes sense to cash in on your home’s value when you start to see warning signs. Acting quickly could allow you to sell before your equity is lowered.

HomeGo makes selling your home easy. You’ll receive a firm offer on day one and your sale can close quickly. You don’t even have to worry about an appraisal, showings, or making repairs. HomeGo offers a smart way to avoid the pain of foreclosure (either your own or your neighbor’s) and walk away from the home with cash in hand.