It’s not uncommon for property owners with trust-owned properties to ask a real estate agent how to sell a house owned by a trust and what the benefits of doing so are. And, if you’ve done your homework, you probably realize that there’s more to it than just getting paid and transferring the deed to the new owner. Fortunately, selling a trust property isn’t as difficult as it seems when you’re working with a real estate agent who’s familiar with this sort of transaction. Let’s get into it.

How to Sell a House Owned By a Trust: The Basics

Trusts, which are also known as trust funds or trust accounts, are legal arrangements that make sure someone’s assets go to certain people in the future. By transferring assets to a trust account, the creator of the trust (called the grantor or settlor) gives the trustee (the entity that manages the assets) the authority to manage those assets (assets can be money, real estate, cars, and other valuable items) in a way that benefits either the trust’s creator or the trust beneficiaries.

What’s unique about trusts is that the asset no longer belongs to the creator of the trust, and it doesn’t belong to the trustee. Assets in the trust belong to the trust. Also, there are a variety of trusts, and each of them is designed to meet specific goals. Sometimes trusts are used to reduce or eliminate estate taxes. Some trusts are designed for people and pets; others are designed for charities and nonprofits.

There’s even a “payable-on-death” trust, more commonly known as a Totten Trust. This particular type of trust, however, cannot be used to manage real estate.

Types of Trusts

There are many types of trusts, but for the purpose of this article, we’ll focus on the three main types:

Revocable Trust (also known as a Revocable Living Trust)

When someone sets up a living trust, they do so while they are still alive. They use them to plan for the future if they become unable to care for themselves and to escape probate. They make it possible for the grantor to change who gets what while they’re still alive and cognizant.

Since revocable trusts don’t have to go through probate, the terms of the trust are kept secret. Unlike irrevocable trusts, however, they can’t protect trust assets from creditors and other outstanding debt or offer many tax benefits.

| Pros of Revocable Trust | Cons of Revocable Trust |

|

|

|

|

|

|

Irrevocable Trust

Once an irrevocable trust has been established and funded, it can’t be modified or altered in any way. Irrevocable trusts are frequently used to reduce estate taxes for the trust’s beneficiaries by transferring ownership of assets from the grantor to the trust.

After the grantor’s death, these trust accounts are often used to receive and store assets, and they can also hold gifts for the grantor’s heirs or beneficiaries that are intended to last a lifetime.

| Pros of Irrevocable Trust | Cons of Irrevocable Trust |

|

|

|

|

|

Testamentary Trust

When someone dies, their Last Will and Testament spell out how their assets will be distributed to specific people they name as heirs. This creates a testamentary trust. Unlike living trusts, a testamentary trust only becomes effective once the grantor dies.

These trusts are usually used by people with young children, and they’ll have access to those assets when they reach a certain age or have a big life event like graduating or getting married.

| Pros of Testamentary Trust | Cons of Testamentary Trust |

|

|

|

|

|

|

How to Sell a House in a Trust

How do you sell a house that you received through a trust? It depends on what kind of trust the property was in, because that will have an impact on the selling process.

Step 1: Talk to the Trustee and Beneficiaries

The trustee is in charge of the trust and may be able to give you more information about how to proceed. Sometimes, you may even have to get their approval before you can sell the property.

If you’re selling a house in a revocable trust:

If someone puts their house up for sale through a revocable trust, the grantor can change the trust deal at any time. If the grantor wants to make any changes to the trust, they’ll have to get in touch with the trustee and send written notice of the changes. If the grantor is still living and decides to sell the property, for instance, they can either:

- Sell the house and keep the profits in the trust for safekeeping until the grantor dies.

- Request that the trustee transfer the title back to the grantor, who will then sell the property and put the profits into a new trust.

If you’re selling a house in an irrevocable trust:

An irrevocable trust means that the grantor cannot change the terms of the trust without the approval of the people who will benefit from it. The trustee must do one of the following to sell the house:

- Get permission from each beneficiary to give the property’s title to the grantor.

- Sell the property while it’s still in the trust, and then the beneficiaries will get their share of the profits from the trust as outlined in the agreement.

If you’re selling a house in a testamentary trust:

A will is used to establish these trusts, and they do not become operational until after the grantor has passed away. They lay down detailed rules and regulations for the distribution and management of assets. There is usually less red tape involved when selling a home held in a testamentary trust after the owner has passed away. The trust’s terms specify the conditions under which you may sell. One example of a condition could be that you have to get approval from beneficiaries before you can move forward with your plans.

Step 2: Talk to a Real Estate Agent

When it comes to selling a trust-owned property, you might want to work a real estate agent with experience selling trust-owned real estate. They’ll be able to offer experience and insight into this process. If you decide to work with one, they will provide some valuable services. This usually includes things like take professional photographs, create the listing, market the property, and draw up contracts for the sale. They can help you through the sale process and even negotiate on your behalf.

Selling a house owned by a trust, especially after facing common household repairs like flooding, roof leaks, and electrical malfunctions, can be daunting. Working with an agent can eliminate concerns over technicalities and repairs simplifying the selling process.

*At HomeGo, we have local agents experienced in these specific types of transactions that can help you sell the house in the trust quickly with not closing costs. Give us a call or fill out the form on our homepage.

Step 3: Get an Appraisal

As soon as you’re given the all-clear, you should have the property evaluated by a licensed appraiser, who will assess the property and tell you it’s fair market value. By doing this, you’ll be able to set a fair asking price, which could lead to a quick sale. After they make an offer and you’ve accepted it, some lenders might require potential buyers to get the property appraised as part of the qualification process before they approve their mortgage application.

Step 4: Gather All the Important Documents

You will require the necessary legal paperwork, such as the trust agreement and the property deed, in order to sell a trust-owned home. Since the transaction must follow the conditions of the trust, you’ll want to hire an attorney with experience in real estate and trust laws. They have to go through all of the documents of the transaction, as well as the trust documents, to make sure everything was done in accordance with the terms of the trust agreement.

Step 5: Accept an Offer and Close

With the assistance of your realtor and real estate lawyer, carefully examine each offer that you get on the property to make certain that the terms are reasonable and in accordance with the trust agreement. When you have finished reviewing the bids you received, the next step is to accept one and then execute the sale.

Lastly, once the sale is finalized, the trustee has to deliver the deed to the buyer and give the beneficiaries a written record of the transaction.

How to Sell a House Owned by a Trust: FAQ

Q: Can You Sell Your House in a Trust to an All-Cash Buyer?

A: Even though most people wouldn’t believe it, an all-cash buyer can buy a home under a trust. In this scenario, the beneficiaries would have the trustee handle all aspects of the transaction, including negotiations and execution. Also, it’s important to make sure that the sale terms are in line with the trust terms and that all legal requirements are completed.

There are many advantages to selling a trust’s home to a cash buyer. They include:

- Bypass the traditional sales process and avoid lengthy delays, costly repairs, and other expenses

- Greater flexibility and control over terms of the sale, allowing for negotiation of a favorable price and closing date

- Quick and efficient access to inheritance for beneficiaries

- Ability to use the sale proceeds for beneficiaries’ financial goals and needs

- Potential for reduced tax liability compared to traditional sales

- Preservation of privacy compared to the public probate process

- Asset protection for assets in the trust

- Streamlined process managed by the trustee on behalf of the beneficiaries

- Opportunity for the sale to be part of a larger estate planning strategy.

Q: What Are the Tax Implications of Selling a House in a Trust?

A: Although there are some tax benefits from putting assets into a trust, Uncle Sam will still want a cut. Upon the sale of a trust-owned property, someone has to pay, be it the grantor (the property’s original owner), the trust itself, or the beneficiaries. These unavoidable taxes include:

- Capital Gains Taxes: Unfortunately, any profits that are made on a real estate sale are subject to a capital gains tax. If you meet certain qualifications, you may be eligible for capital gain exemptions. So, if you sell a house in a trust, don’t be afraid to ask your tax advisor if you’re eligible come tax season

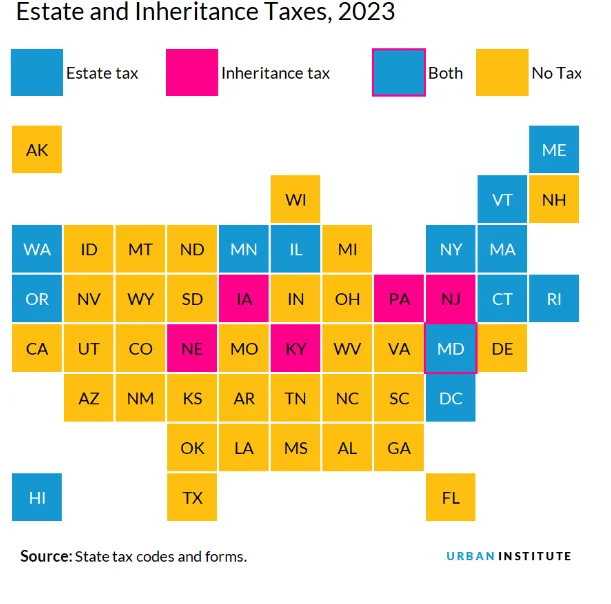

- Estate Taxes: Despite how you feel about the “death tax,” you, your trustee, or your beneficiaries are responsible for paying a federal estate tax, which can range from 18% to 40% of anything over $13.61 million. If you live in one of these 12 states (plus Washington DC) you’ll be double-taxed, as you have to pay their estate tax.

- Inheritance Taxes: Upon death, there are six states that will charge an inheritance tax on top of the federal estate tax. Maryland, however, requires residents to pay both inheritance and estate taxes on top of the federal inheritance tax! Urban.org has an excellent article that goes into much more detail than we can here.

Credit: Urban.org

- Stepped-Up Basis: Sometimes, after inheriting property, you can give yourself a stepped-up basis, which is a tax advantage. By increasing your basis, you can ensure that when you sell the property, its value will be based on what it was worth when you inherited it rather than what the previous owner paid for it. This is to avoid paying taxes on the difference between the two values. In some cases, this can lower your tax bill. Investopedia goes into more detail about stepped-up basis tax rules in this article.

Q: What Happens to the Money After the House Is Sold?

A: It is the responsibility of the trustee to protect the trust’s assets and make sure the trust is productive for the benefit of the beneficiaries. It is important for the trustee to have a bank account in the trust’s name so that the sale stays legal and follows all state rules. The funds will be transferred to the account as soon as the sale is finalized. After that, it’s up to the trustee to figure out how to reinvest the funds in a way that will benefit the trust and its beneficiaries.

How to Sell a House Owned By a Trust: Final Thoughts

Many people assume that selling a house that is held in trust will be difficult; however, this doesn’t have to be the case. You need a network of professionals who are knowledgeable about and familiar with the nuances of selling a trust-owned home in order to ensure a smooth transaction.

HomeGo has created a better way for homeowners to sell their homes with as little stress as possible. All it takes is a 30-minute walkthrough with one of HomeGo’s registered real estate agents, and you could have an all-cash offer by the end of the day. The choice is clear: if you want to sell your home quickly without a fuss, HomeGo is the place to go.