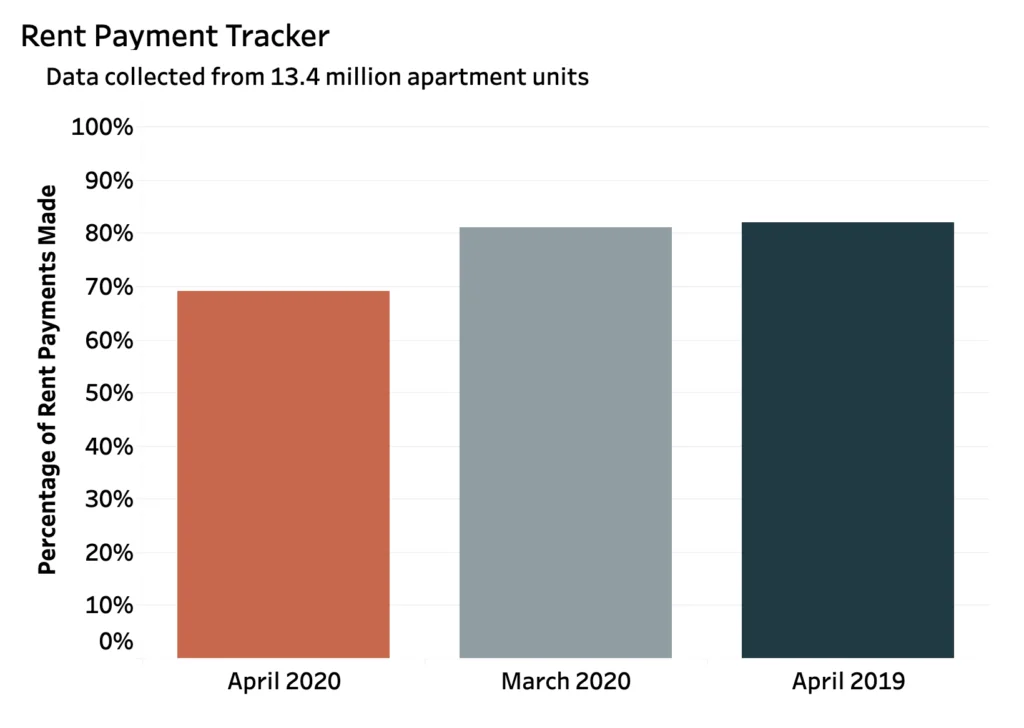

As COVID-19 fears and realities rage on, joblessness rises, sending ripples through the economy. Not surprisingly, The National Multifamily Housing Council found that around 31% of renters couldn’t pay rent in April.

That’s over a 30% increase from April of 2019.

In NYC and harder hit areas, The New York Times analysts report that the rate of missed rent payments may climb to 40% within the few several months. This puts renters further behind. And as a result, small landlords with shrinking maintenance accounts struggle to pay mortgages and upkeep.

Are you already feeling the pinch?

The COVID-19 Real Estate Impact

Larger real estate companies and REITs are feeling the pain, no doubt. But as with so many things in life, it’s the little landlords who have little to fall back on in a crisis. And according to a survey by CNBC, 58% of small landlords say they don’t have access to lines of credit.

Historically, you’ve been able to rely on the majority of your tenants paying on time. But a March survey showed that some 54% of renters polled have recently become unemployed because of COVID-19.

Many are now relying on the help of loved ones to get by. And with many cities forbidding evictions, rent is no longer a priority. It may not be for some time. We may also see tenants abandoning properties to flee hard-hit areas.

While we like to think our economy can bounce back from anything, events like 9/11 and the 2008 Housing Crisis show us that recovery can take some time.

As a small landlord, you’re probably more connected to the people in your properties than a big faceless company would be. So it’s hard to ask for rent when you know that your tenants are in this kind of situation.

Empathy, however, doesn’t pay your bills. In fact, utilities and maintenance costs may have gone up because people are spending much more time at home.

Coronavirus’ Collateral Damage to Rental Prices

On top of a mountain of missed rental payments, some markets are seeing rental prices drop. These may continue for months.

Los Angeles price per square foot has already dropped from $2.51 to $2.49. It doesn’t sound like so much until you do the math. Then you realize you’re losing $15 for every 750 sqft of property you own.

Even if the COVID-19 economy shutdown only lasts another month or two, renters will be worse off financially. As a result, they’re likely to downsize, leading to further drops in rental value.

And this couldn’t come at a worse time. You’re trying to recover while rental prices drop pinching your budget further.

But we can’t put all of the blame on coronavirus. Rental prices were already showing signs of decline. That’s an indicator that there was already a recession on the horizon.

A Lifeline for Small Landlords

Many landlords don’t have the bandwidth to maintain the number of properties they own as profits shrink. Rentals are no longer lucrative enough to justify the stress and time-investment.

HomeGo buys properties fast from these struggling landlords, regardless of condition, tenants or not. We make selling properties fast and easy, freeing up cash flow and your peace of mind.

Within just a few days of speaking with one of our knowledgeable representatives, you could be out from under the weight of your low return, no return properties.

HomeGo is the smart, straightforward, and trusted way for landlords to sell properties that aren’t making money so they can focus on the ones that still do. Contact a HomeGo Representative to get a no-obligation offer on your property.