Inheriting a house can be a financial boon or a financial burden, depending on what you do after you take ownership of the home. When a loved one passes a property through inheritance, they are also passing the financial situation of that property.

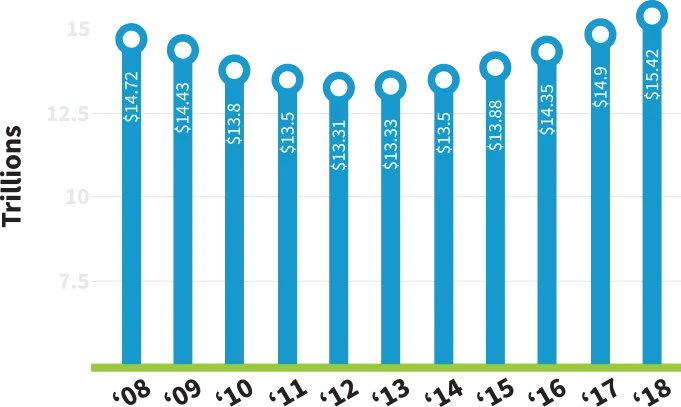

Mortgage Debt Trending in the United States

The Different Kinds of Mortgage Issues You May Inherit With the Home

Due On Sale Clause

Most mortgages have a clause that stipulates the existing mortgage balance must be paid when the home changes ownership. However, there’s an exception for houses that are inherited.

Called the Garn-St. Germain Depository Institutions Act of 1982, the act allows a close relative (like a spouse or a child) to take over the existing mortgage instead of refinancing.

If someone else is on the home title, they’re also usually exempt from the clause (that includes surviving spouses). If you’re not a close relative or a joint title-holder and the lender exercises the due on sale clause, you’ll need to arrange for your own mortgage right away, typically within 30 days.

Reverse Mortgage

A reverse mortgage is like a home equity loan, but instead of making repayments all along the way you would with a home equity loan, the reverse mortgage loan becomes fully due once the owner leaves the property, either by moving out or as a result of their death.

If you inherit a home with a reverse mortgage, you’ll have a set time (often six months) to repay the loan. Otherwise, you’ll need to sell the property to satisfy the debt or get your own mortgage and use the money to repay the reverse mortgage balance.

Review the reverse mortgage documents very carefully so you know how much time you have before the loan comes due.

Underwater Mortgage

An underwater property is one in which the amount owed on the mortgage exceeds the market value of the home. That means if you sell the home to pay off the mortgage, you’ll be left owing additional money.

In that case, other assets from the estate will almost certainly need to be sold or liquidated to cover the remaining balance. If that’s still not enough (and you can’t or don’t want to make up the difference), in most cases the house will revert to the lender.

In some instances, the executor might be able to arrange a short sale where the home can be sold for less than what’s owed. You could assume the mortgage and pay it down yourself or you could refuse the inheritance and be rid of the hassles entirely.

Mortgage Paid by Estate

Now suppose the home has a mortgage that’s less than the home’s market value (so it’s not underwater), but you don’t want to take over the mortgage or pay off the balance with a new loan (or your own funds).

In that case, the mortgage balance might be paid off with funds left in the estate (annuities, IRAs or other accounts) or you might be able to arrange the sale of other estate assets like antiques or other valuables to pay off the mortgage.

That all depends on the individual lender and the process they follow when a mortgaged home is inherited. Again, talking with a probate attorney could be a good investment of your time and money to avoid running afoul of probate rules or other laws.